The best way for a commercial real estate tenant to get value and low cost has been to find a good sublease. In fact we have a few clients that just move from sublease to sublease every other year, finding the cheapest deal they can. However with the improving economy and commercial real estate market, the days of the cheap sublease have begun to go away.

Where Did All of the Subleases Go?

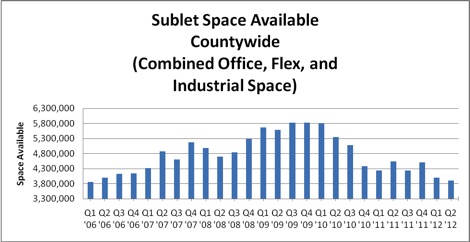

Current availability of sublease space in San Diego County is back to 2006 levels, as the chart below indicates. By any measure, 2006 was one of the strongest commercial real estate markets in the last 15 years, when availability rates were at their lowest levels and rents were high. The decrease in the amount of sublease space is the first result of the improved economy, as companies have hired back employees in the last two years, and fewer companies have needed to put sublease space on the market. Second, given that subleases expire and have a terminal date, the passing of time has resulted in some subleases expiring and reverting back to the building owner. Each year, a certain percentage of subleases will roll back to the landlord. Third, because there are fewer subleases, when a good low price sublease comes on the market, it tends to go fast. Good subleases today are generally gone within 3-6 months of them being listed.

Sublease Space is an Economic Indicator

I have been tracking the total amount of sublease space in San Diego County for nearly 15 years. For me, it’s a critical statistical indicator that tells a story about where the overall economy is heading. Back in 2000, just before the stock market crashed early that year, we had clients coming to us in droves to get out of space that they had committed to. Literally every week, a client was laying people off and needed to sublease of space, and this was before the stock market crashed. That leading-edge information was followed by one of the worst economic corrections in our time, and a massive glut of both sublease space and space that was overbuilt by landlords. 2002 ended with 7.4M square feet of sublease space on the market!

Then we saw the economy getting overheated in 2006, and sublease space started edging up too. While every other commercial real estate firm was tracking rising rents and lowering vacancy, we were looking at indicators that showed things were not as healthy as everyone thought—like the increase in sublease space, which tells so much more about the health of companies in the region. Back in January of 2006, I wrote in our quarterly client market update that “the market momentum developed in 2004 and 2005 will stall in 2006, and we are already seeing early signs of this. While landlords and their brokers have geared up the propaganda campaign to make the market seem tighter than it really is, they haven’t tuned in to the harsh reality that facility demand in San Diego has slowed.” While we were feeling this anecdotally on the ground, the data to back it up was playing out with an increase in total sublease space on the market. By 2007, sublease space on the market was picking up steam, and my partners and I were out in the market talking about the coming economic storm, and likely recession, well before the stock market crash in 2008.

…And Now the Good News!

Look for sublease space availability to continue to decline through 2013, as the San Diego regional economy continues to create jobs and improve. As we survey market options for clients, there is a general shortage of good subleases on the market. Also, the “great deals” that subleases used to represent have thinned, as sublessors are not pricing their subleases with as much of a market discount as we used to see. Just a few years ago when office space in UTC cost $3.50, subleases could be had for $2.00. We could often negotiate a 30%-40% discount on subleases. Now with the firming market, and shortage of subleases, that savings is reduced down to 10%-15%. But those savings aren’t that great when you consider that a sublease is generally offered “as is” and landlords are still willing to provide generous tenant improvement allowances. The savvy tenant today will look at sublease as an alternative, but not as the single best solution for their needs.

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.