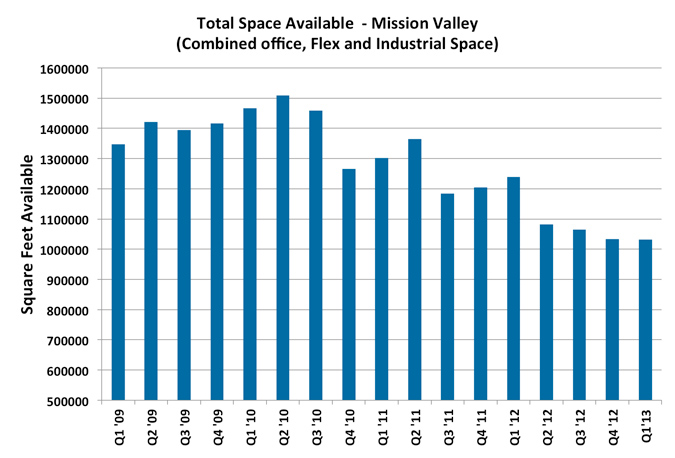

The Mission Valley office submarket comprises 7,036,000 square feet of office space. The commercial leasing fundamentals for Mission Valley have improved over the last 18 months along with the recovering economy, and the availability rate currently stands at 15.62%.

Mission Valley’s central location, value rental rates, free parking and retail amenities have made it a preferred market for regional offices of national corporations, insurance companies and a host of other business services firms. Examples of large insurance tenants include United Health, AIG, MetLife, Aetna and Lincoln National. Defense contractors also favor Mission Valley, as they seek quality office space in proximity to SPAWAR with ample free parking. Larger defense companies occupying space in Mission Valley include CACI, Booz Allen, General Dynamics, TASC, Qinetiq, VPSI, and there are myriad smaller defense contractors throughout the submarket as well.

The Checkerboard

The following requirements have recently signed leases in Mission Valley:

- State Farm, lease renewal for 54,000 square feet.

- Liberty Mutual, relocation from downtown for 50,000 square feet.

- State of California, Water Resource Control Board, new location for 28,000 square feet.

- UCSD, expansion for 15,000 square feet.

- Stewart Title, lease renewal for 14,000 square feet.

- Victory University, new location for 11,000 square feet.

Other significant transactions that have applied upward pressure on Class A rents in the preceding 18 months include Encore Capital Group’s ongoing expansion and OptumRx (doing what?) at Centerside and the Veterans Association for over 40,000 SF at the Hyundai Building.

Buyers & Sellers

Last summer, The Irvine Company doubled-down in Mission Valley with their purchase of 200,000 square foot Centerside I for $52 Million. They already owned the sister building, Centerside II, which came along in their 2007 acquisition of the Blackstone/Equity Office portfolio of 15 UTC office buildings. Irvine dramatically reduced their “effective” rental rates to fill up the vacancy in Centerside over the last two years, and it has worked. In Q1 2011 Centerside I & II had a combined vacancy rate of 34%. The project vacancy rate is now at 4%.

CommonWealth Partners stepped back into the Mission Valley market in Q4 2011 as asset manager for CalPERS in their purchase of the 2-building 438,000 square foot Pacific Center, just northeast of the 163 freeway and Friars Road, for $116,000,000. Previously at 32% percent vacancy, this project should approach 10% vacancy by the close of 2013.

Powerhouse REIT Kilroy Realty liked what they saw and got in the Mission Valley game in 2010 with their purchase of 280,000 square foot Mission City Corporate Center for $70.5 Million from Maguire. Since purchasing the project Kilroy has managed to reduce the vacancy rate from 45% to 14%.

Sudberry Properties is bullish on the submarket, as evidenced by the 900,000 square feet of office and retail space currently planned as part of their massive Civita development on the north side Friars Road just west of the I-805.

And Papa Doug Manchester, proud new owner of the San Diego Union-Tribune, wasted no time in announcing plans to redevelop the newspaper’s Mission Valley headquarter property into a new Class A, 9-story office tower, with 230,000 square feet available for lease as part of a mixed use office, retail and residential project.

What To Watch

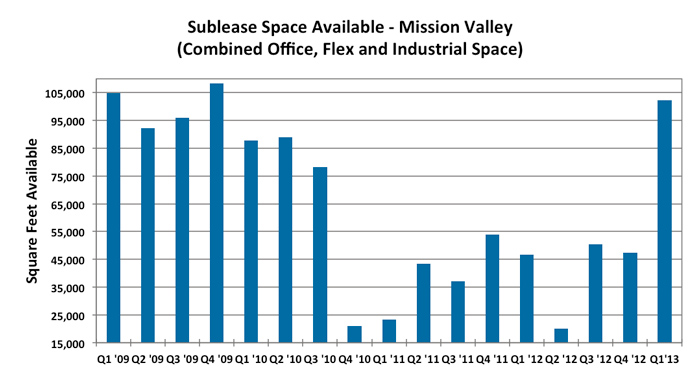

There has been a recent spike in sublease space available in Mission Valley. We attribute this primarily to the effects of sequestration as many of the subleases are from defense contractors. This availability bump may suppress rents in the short term but we don’t expect it to dampen a full-fledged recovery of the submarket.

Mission Valley is one of the few office markets in San Diego County that has excellent retail, hospitality, residential and mass transit, all of which support the office space component of the Mission Valley submarket. The lack of large blocks of space, particularly in Class A buildings, will continue to put upward pressure on rents as the recovery continues.

John Jarvis is a managing director at Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact John at 1-844-662-6635 or john@hughesmarino.com to learn more.