By Tucker Hughes

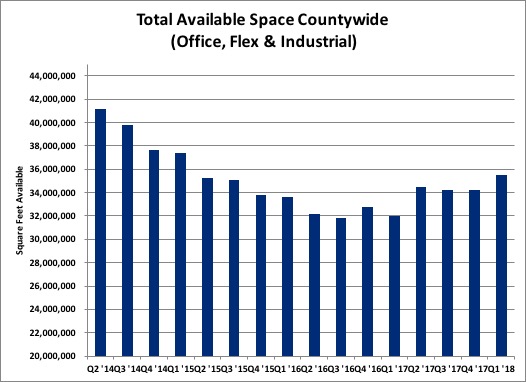

Orange County’s commercial real estate market continued to show its strength through the first quarter of the year posting positive metrics across the board. Developers remain bullish as their 1.93 million square feet of speculative new development underway (combined office and industrial product) is already 65% pre-leased, continuing to validate their “build it and they will come” thesis. Despite an increase of total available space of 1.2 million square feet over the prior quarter, bringing the countywide total to 35.5 million square feet, this bullishness continues to apply upward pressure on rental rates and downward pressure on vacancies.

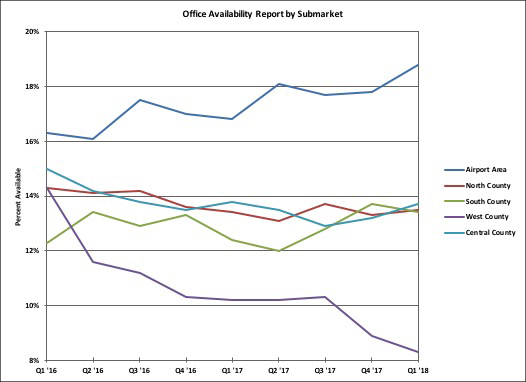

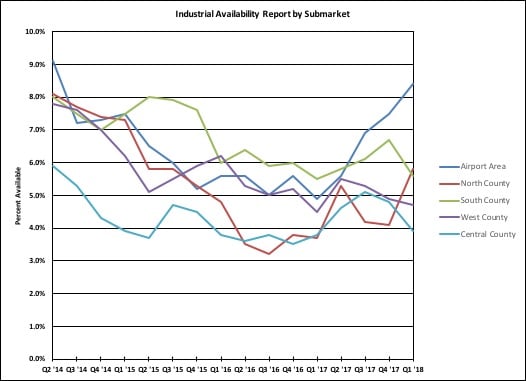

Countywide, we saw slight upticks in average asking rents with office rates hitting $2.50 per square foot and industrial rates hitting a historical high of $1.05 per square foot, both up from $2.49 and $1.04, respectively, over the prior quarter. Despite rental rates at (industrial) or near (office) historical highs, industrial vacancies dipped to a historical low of 2.4%, while the office sector increased from 9.5% to 9.7% quarter over quarter, which is largely due to the 500,000 square feet of new development that hit the market this quarter.

While asking rental rates continue to climb, their rate of appreciation is slowing, continuing a trend we’ve seen since the third quarter of 2017. Office rates grew at a 3.9% year over year (YOY) clip, down from 4.5% in the previous quarter, while industrial rates increased 5.9% YOY, down from 6.6% the prior quarter. This trend indicates market strength in the near term, but may signal a cautiousness for how much longer this growth cycle can continue.

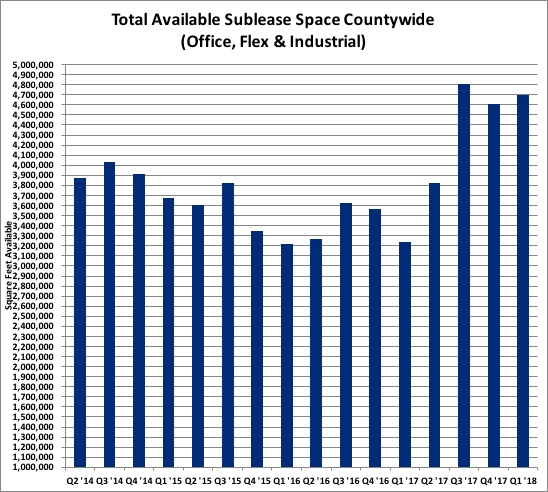

As the total space available hit 35.5 million square feet, the total sublease space available slightly increased by 90,000 square feet to a total of 4.7 million square feet. The bulk of available space sits throughout Airport Area, continuing the softening trend that’s plagued the submarket as companies seek more vibrant, amenity rich submarkets like Irvine Spectrum. Irvine Company’s UCI Research Park has nearly 1 million square feet on the market as Broadcom completely exits the campus to their new home in Irvine Spectrum. However, whispers in the market indicate there’s over 700,000 square feet of active transactions currently underway at UCI Research Park, which, assuming a portion of those deals materialize, will significantly impact the supply and pricing optionality for the submarket overall.

The Boardwalk, Airport Area’s newest Class A speculative office project, is now 40% pre-leased, breathing signs of life into one of the priciest buildings in town. The Flight Campus, Lincoln Properties’ speculative campus office under construction at Tustin Legacy, continues to take shape and is slated to be one of the most amenity rich projects in the region once finished. Dog parks, food mess halls, walking trails and yoga studios–sounds fantastic, right? The project is yet to secure a tenant, so time will tell if the progressive building designs and project amenities will justify the hefty price tag. We’ll continue to keep a close watch for new developments here and throughout the region so stay tuned for more.

Tucker Hughes is managing director at Hughes Marino, a global corporate real estate advisory firm that exclusively represents tenants and buyers. As head of Hughes Marino’s Orange County and Los Angeles offices, Tucker specializes in tenant representation and building purchases throughout Southern California. Tucker makes frequent media appearances to speak on the future of commercial real estate, and is also a regular columnist for Entrepreneur.com. Contact Tucker at 1-844-662-6635 or tucker@hughesmarino.com.