While national headlines talk about the battering commercial real estate office space is taking due to hybrid and remote working post-Covid, industrial real estate nationally is entering a second year of taking a hit in most major metro markets around the United States. Caused primarily by extreme overdevelopment in the last three years thinking that the unprecedented 2020 through 2021 demand spike from e-commerce and supply chain needs around the United States would roll on for years thereafter, real estate investors and developers classically overpaid for industrial buildings and overbuilt the markets.

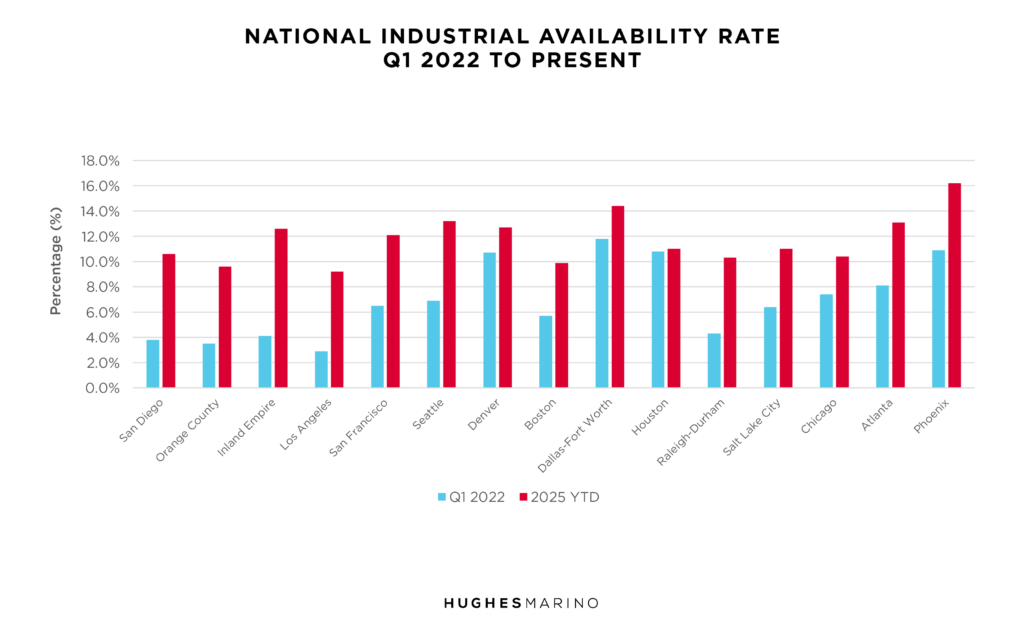

From 2022’s historic availability rate lows, availability rates have spiked in the last three years with a 50%-100% increase in all metro areas, and tripled in previously tight markets of Southern California as the below chart shows.

The historically low single digit availability rates throughout the Southern California region crushed industrial tenants in 2020 through 2021—where rental rates ran up to $1.50 to $2.00 triple net per square foot per month ($18-$24 per SF per year)—literally doubling in a two-year period. But as they say, “The bigger they are, the harder they fall.” Southern California landlords are reeling in these markets, particularly ones who paid retrospectively ridiculous premiums for industrial real estate at historically low cap rates.

Also contributing to the spike in industrial availability rates has been the surge of sublease space around the country. Today there are 252,000,000 SF of industrial space for sublease that surround the country. To put that in perspective, that’s more industrial square footage for sublease than the 219,000,000 SF of office space for sublease in the United States. That should get your attention! As for the Southern California region, almost 34,000,000 SF of industrial space is on the market for sublease, with half of that being in the Inland Empire, where so many national companies have a footprint, or rely on 3PL activities based there.

Some of the softest markets in the country include Phoenix, Dallas-Fort Worth, Seattle, Denver and Atlanta, as those markets have crossed over the 13% availability threshold, moving into the mid-teens where it’s the danger zone for building owners and landlords.

While a lot of industrial tenants still have the perception that industrial real estate is tight and strong around the country, availability rates have fully reversed and are now at or above their pre-Covid levels. We are in a quickly downward moving market where asking rents have little bearing to the soft market realities that we are negotiating. 2025 is shaping up to be the strongest tenants’ market that we’ve seen in years, but tenants need to pick their landlord and their representative carefully, versus listening to the big landlord-promoting listing firms that are doing the landlords’ bidding. A lot of the big institutional owners are locked into capital structures that are inflated based on overpaying for the real estate and are having difficulty transacting at the new market rents. Meanwhile, private landlords and owners with a pre-Covid cost basis are cutting deals at 20% or more below what the big institutional landlords can do. Having the right tenant advisor to lead you through this minefield of a market is essential, as the big landlord brokerage firms are trying to backstop the owners and promote the notion that the market is still strong, even though none of the data or facts support that position.

Market statistics provided by CoStar Group.