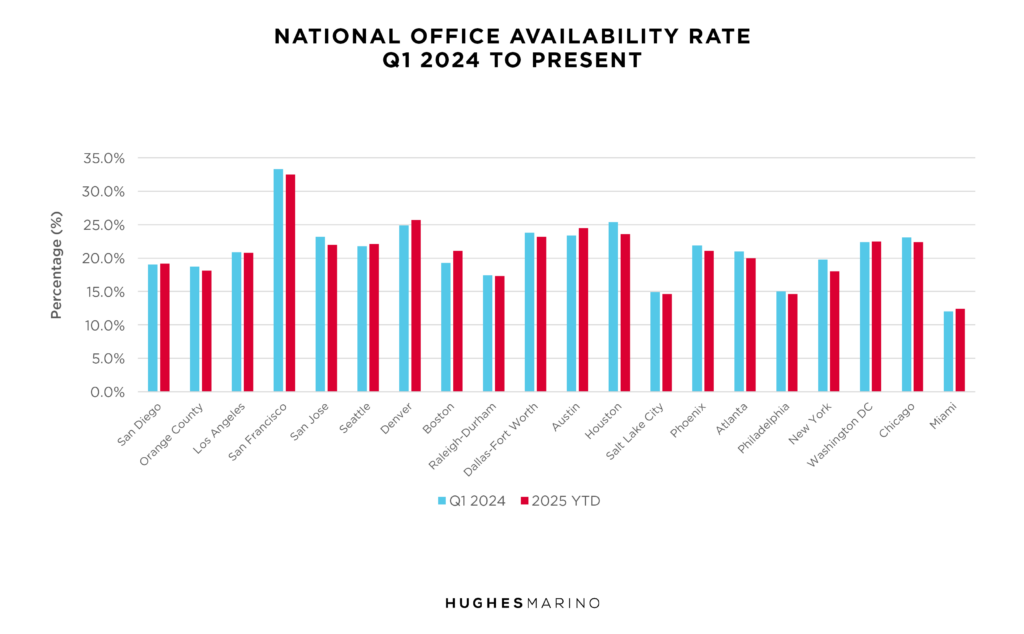

After three years of spiking office space availability rates, 2024 was the first year where the U.S. office market began searching for a bottom. Most metro markets did not see office availability rates materially rise or fall over the last year, which is good news for owners, suggesting that the markets might be stabilizing. There were some notable exceptions moving in opposite directions. Boston’s availability rate increased by almost two percentage points and Austin increased by just over one percent. On the other side, Houston and New York City saw almost a two percent decrease in availability rates, while San Jose and Atlanta each saw a full percentage point decrease. The following chart shows availability rates by metro area from Q1 2024 compared to Q1 2025.

However, the problem now for owners of office buildings is how to dig out of the historically high glut. When commercial real estate markets rise above 15%, that is traditionally a sign of great distress and softness. Anything above 20% availability is historically considered destructive for the asset class. Two-thirds of the major U.S. markets noted above still exceeded that 20% threshold, with Denver exceeding at 25% and San Francisco exceeding at 30%. These extraordinarily high office availability rates are the underlying reason why so many office building landlords have been foreclosed upon, or structured short sales below the building’s debt. Now with a significant number of office building landlords facing loans coming due in the next two years, and the relatively still high interest rates that these landlords will face when trying to refinance, it’s anticipated that we’re looking at another couple of years of widespread foreclosures.

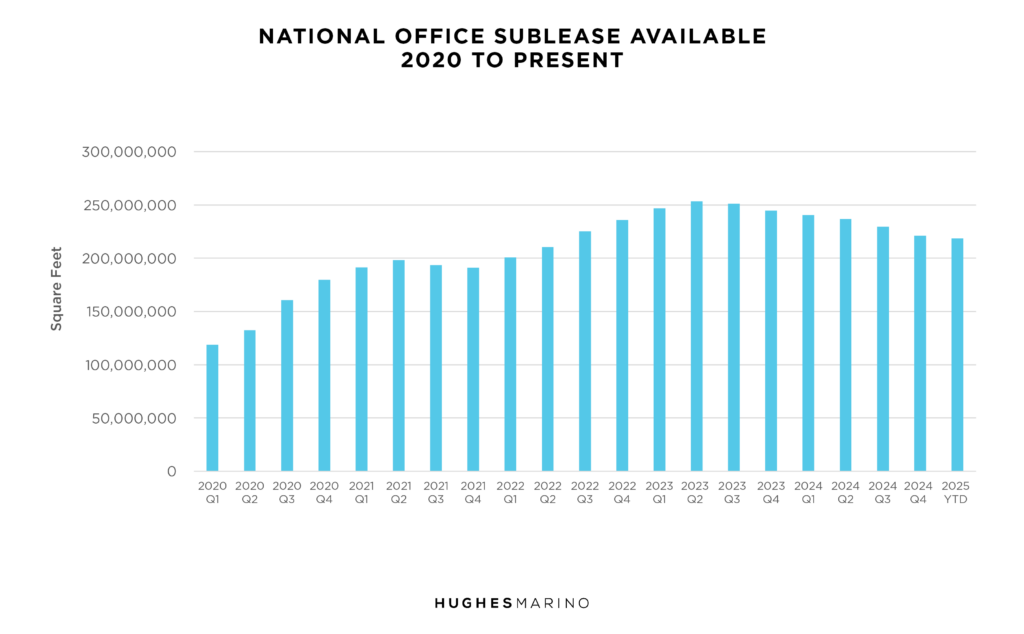

Simultaneous to these signs of stability and slight improvement in some markets, the national amount of office space for sublease has decreased over the last year, as shown in the chart below.

Tenants looking to sublease office space have been aggressive at undercutting the market, hence a reduction in availability as these come off the market. But many of the sublease offerings that have been on the market for two or three years are maturing to lease expiration, and those available sublease spaces are reverting back for the building owners to deal with. While this decline in sublease inventory is a bright light for office building landlords, the sublease availability rate is still double what was seen over years of historic equilibrium, suggesting that the worst is by no means behind building owners.

There’s tremendous speculation of whether the office markets around the United States are going to see a recovery based on so many large companies requiring employees to return to their offices four to five days per week. While that is certainly helpful in stabilizing demand, most small- to medium-size companies often don’t have a formal return-to-office policy, or have embraced remote and hybrid work as a recruiting and retention advantage, and see 2025 operating conditions as the new normal.

The other shoe to still drop on the office market is the fact that approximately 40% of pre-Covid office leases signed still have yet to expire, which will happen one lease at a time over the next four to five years. As a dominant national tenant advisory firm we can see that most of these companies are swimming in space and will generally get by with less when their leases expire. Only time will tell what kind of office space retention occurs, but without any material net growth in office space demand, most landlords will ultimately have to break with their historic pricing or hand the keys back to the lender. Notwithstanding how long the office sector might take to find its bottom, 2025 is sure to continue to be a strong tenants’ market, with some of the best values that we’ve seen in years, for those companies that have prudence to select the right tenant advisor and to go to market to determine their value today.