By David Marino

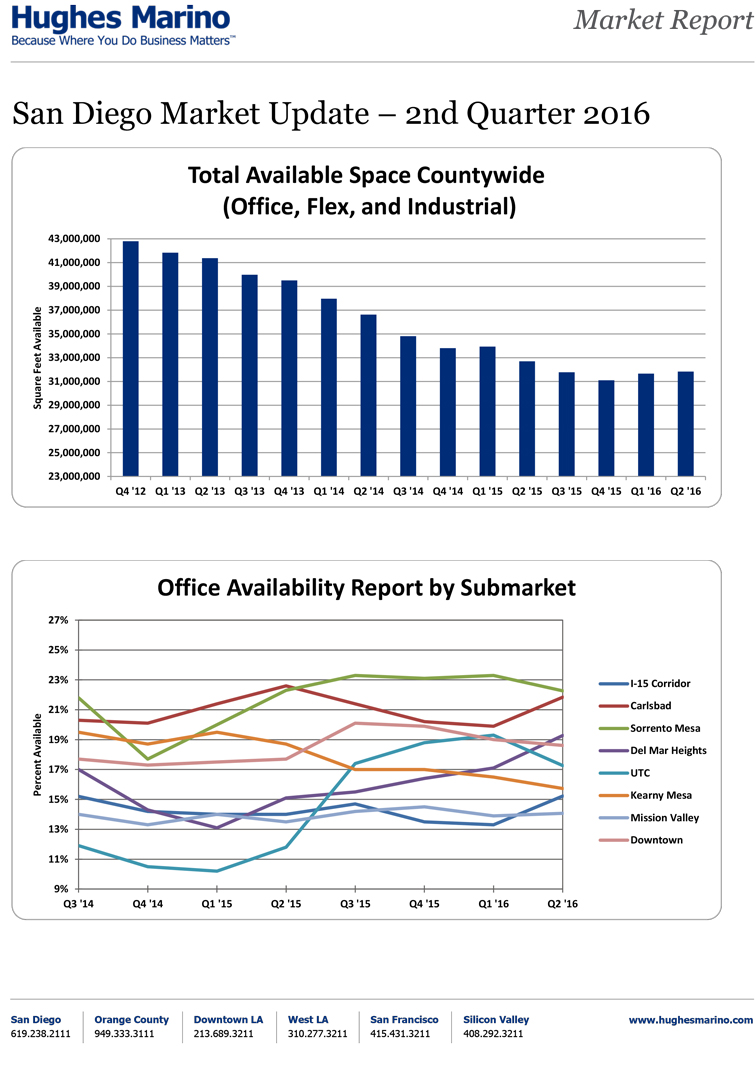

Second quarter 2016 has increased cause for alarm about where the commercial real estate market might by headed. After a 550,000 square foot increase in total availability of office, lab and industrial space countywide in the first quarter of 2016, the second quarter has seen another slight increase in total availability of another 180,000 square feet. This is the first time in five years when we have had two back-to-back quarters of increased availability. It is also the first year since 2009 where year-to-date total availability has gone up versus down, which is a potential signal of storm clouds on the horizon for both employment and economic growth.

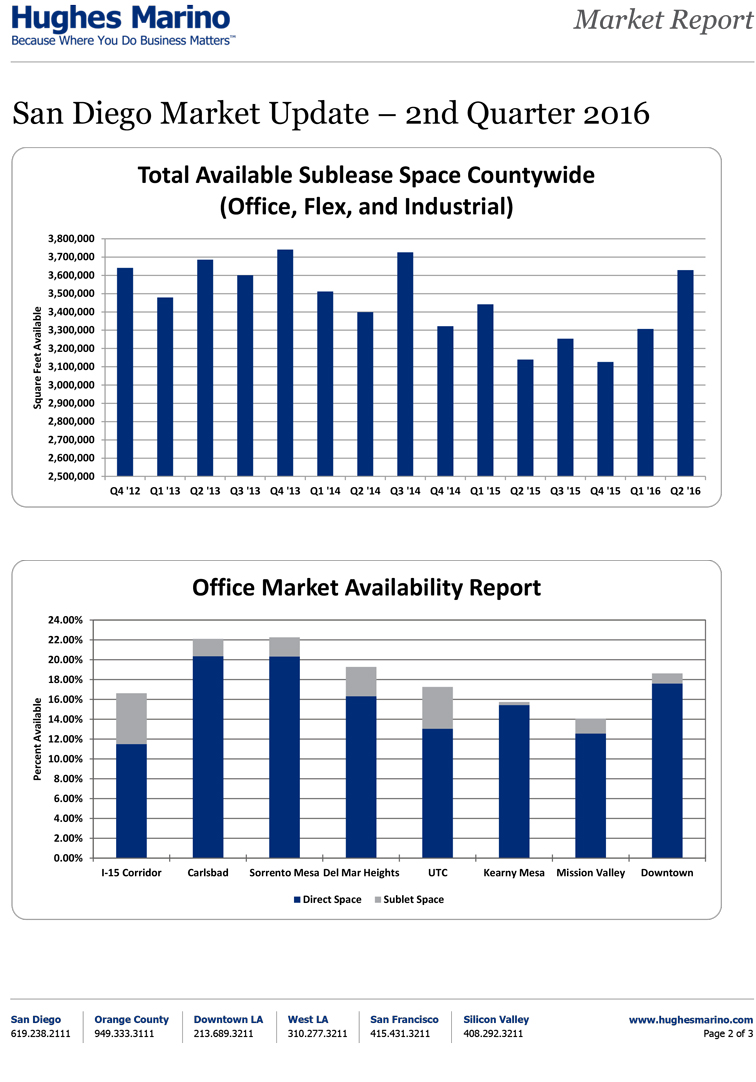

Part of the reason we are seeing this slowdown in demand and uptick in availability is that sublease inventory has increased in three of the last four quarters. This is mostly due to merger and acquisition activity in the marketplace, causing excess space to be dumped in key markets. In particular, sublease availability as a proportion of total availability is highest in UTC, Del Mar Heights, and the I-15 Corridor. In contrast, Kearny Mesa, Downtown, Mission Valley, Carlsbad and Sorrento Mesa all have the lowest availability of sublease space relative to the total availability in their respective markets.

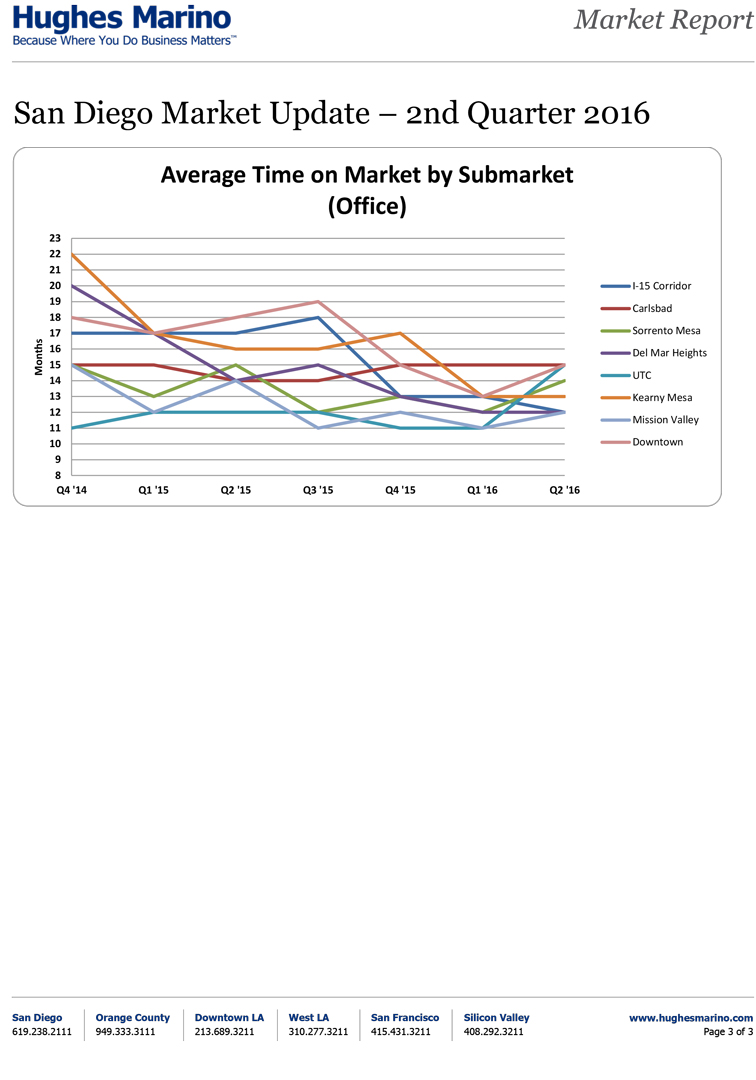

The markets that seem to be regressing the most with respect to office space availability include the I-15 Corridor, Carlsbad and Del Mar Heights, which have each ticked up by two full percentage points of availability just in the last quarter. In contrast, UTC is showing signs of improvement with a 2% decline in total availability just in this last quarter, from 19.3% to 17.3%. With the $600 million UTC Westfield Mall remodel underway and plans becoming realized for the trolley line extension providing mass transit to UTC at the end of 2018, this already popular submarket is becoming even more desirable.

Downtown is a different story. As occupancy continues to climb, some landlords have aggressively pushed rental rates to stratospheric heights (at least for Downtown San Diego). Multiple $5+ per square foot proposals have been trading at DiamondView Tower, and nearly every other Class A building has seen double-digit rental growth since January. Meanwhile, Class B buildings have slowly been filling, and there are no new buildings under construction. This spells lack of options and very high rents in the future…

In all, it continues to be a watch-and-wait market. There is reason to raise eyebrows as to why demand is not stronger in the marketplace. While we don’t forecast a complete return to a tenants’ market anytime soon, we can certainly conclude that the pricing power landlords have had over the last four years is beginning to fade away.

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.