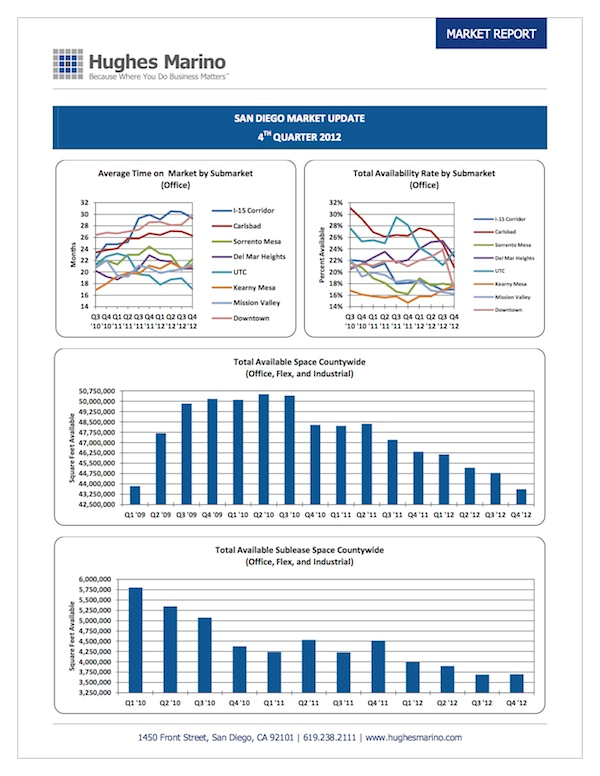

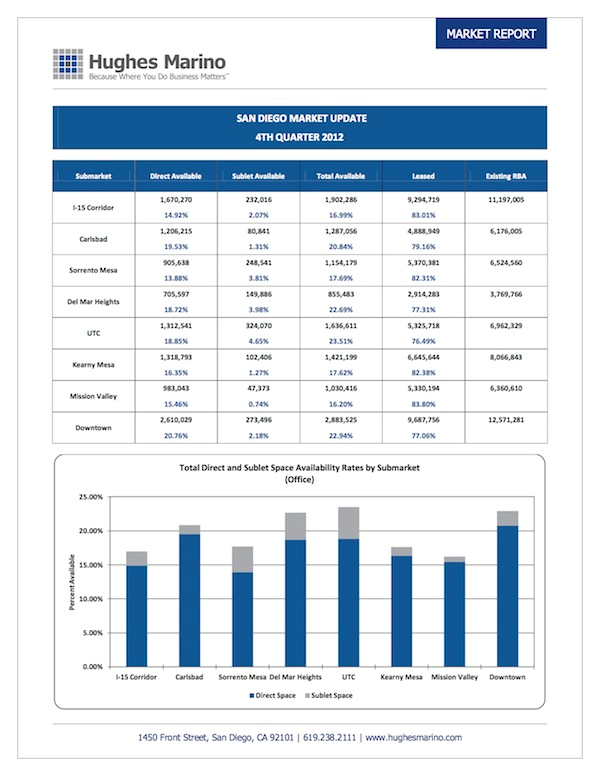

The fourth quarter of 2012 ended with a continued positive market recovery, which is now entering its third-year. 1.18M square feet of office, flex/lab, and industrial space was absorbed in Q4, which is the strongest quarter on record since 2005. 2012 ended with a combined office, flex/lab, and industrial total of 2.72M square feet of net absorption, which is a high not scene seen since 2005. The fact is that all product types are in recovery, as office, flex/lab and industrial all begin to be affected by the recession at the same time back in 2006, peaking in supply in the middle of 2010, and all recovering in parallel. Carlsbad is the office markets showing the most recovery, which has been otherwise lagging since 2007. Downtown remains at 23% availability, however, that will now begin to decline due to pent-up demand and newly relocating suburban tenants moving into the area.

Segmenting Class A from Class B office, Class A is showing the most significant recovery, with Class B office availability being dead flat for the last 3 years, and continuing to drag on what otherwise is a recovery for office space in the region. Total sublease space in the region continues to be in short supply, at the lowest levels in 7 years. While the graphing might look like there is a glut of sublease space in UTC, Sorrento Mesa and Del Mar Heights, over half of the Del Mar Heights sublease space is in final negotiations for coming off the market this month. In Sorrento Mesa, four of the largest subleases totaling 164,000 are being either pulled off the market, are in sublease negotiations to close, or are expiring this year turning into “direct” space, and thus coming off the sublease inventory. In UTC, it’s a different story, with Amylin still having just over 100,000 sf of office and lab space to dump, Illumina still working to sublease their former 197,000 sf campus, and Lockheed Martin looking to get out of a 120,000 square foot campus. Those large sublease will continue to hurt the market recovery in UTC for some time. With the additional dumping of space by LPL Financial along the Towne Centre Drive corridor in UTC, which will move into its new 400,000 square foot office building under construction just northwest of the I-805 and La Jolla Village Drive intersection, UTC Class B office space is where the values are going to be in 2014 for large tenants. In downtown, a 156,000 sf building (former home of American Specialty Health) is in escrow to a high-rise condo developer – which would eliminate the largest block of vacant space in the area.

© 2013 Hughes Marino, Inc. All rights reserved.

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.