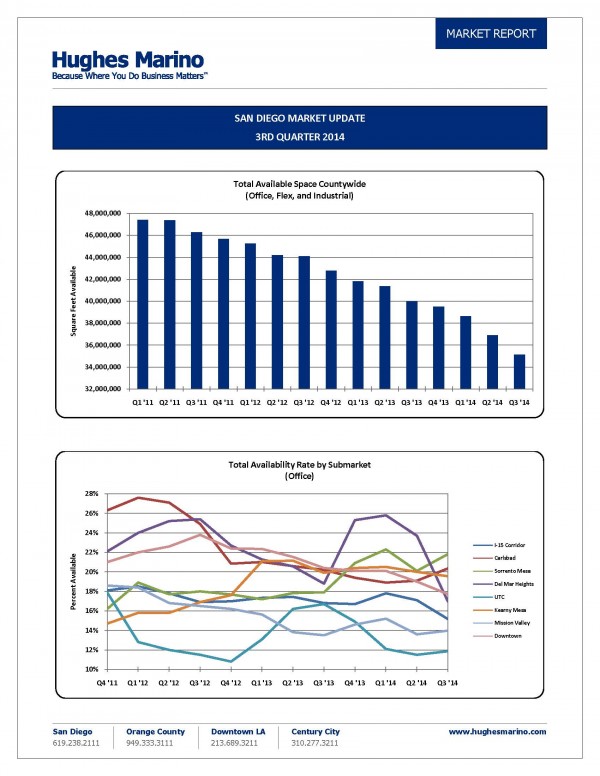

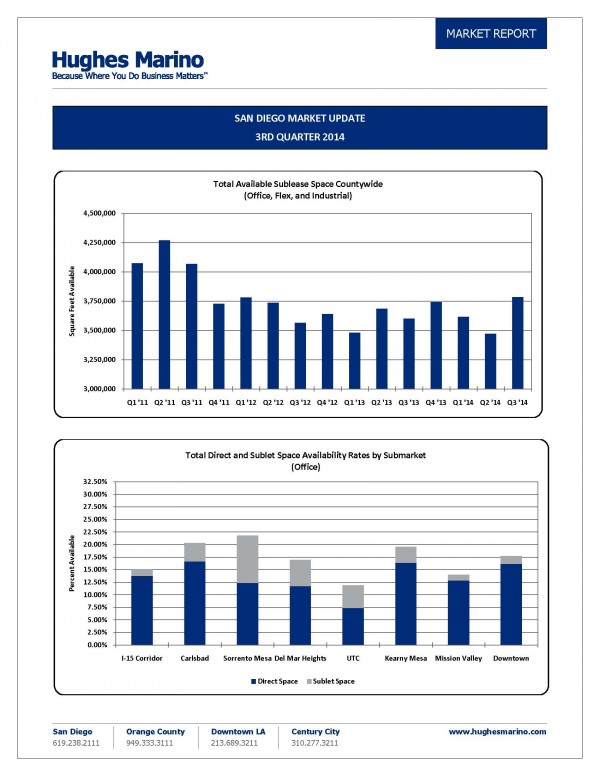

Third quarter 2014 ends with continued, dramatic improvement in the commercial real estate market across all product types. In this past quarter, another 1.77 million square feet of lab, office and industrial space came off the market. This is consistent with the real estate recovery in the second quarter when 1.73 million square feet came off the market. 2014 year-to-date net absorption is almost record setting, with just under 4.4 million square feet of net space having come off the market. This represents the best year-to-date results since the strong economy of 2006.

Meanwhile, office availability by submarket is shifting radically. Most notably is in Del Mar Heights, where it was anticipated that AMN Healthcare was going to potentially relocate, and their space was put on the market as available. But AMN ultimately renewed, eliminating the artificial spike in availability rates and driving Del Mar Heights down to a three-year availability low. At the same time, Sorrento Mesa office availability has clipped up due to Active Network putting their entire 125,000 square foot corporate headquarters on the market for sublease.

Downtown San Diego has also experienced a steady increase in rates and decrease in vacancy. Between the twenty-two high rises downtown, 110,000 square feet have come off the market so far in 2014 (soon to be 120,000), making this the first time downtown has exceeded 100,000 square feet of absorption since 2005. A more significant change has occurred in the downtown Class A market, which is hovering near the 5% vacancy mark. With the Department of Justice Attorney General committing to One America Plaza (moving from 110 West A Street, a Class B building) and taking 120,000 square feet of available Class A office off the market, combined with a land grab by companies vying to secure the last view spaces in town, there are more Class A buildings over 95% leased than under 95% leased.

The downtown Class B market, on the other hand, is a mixed bag. 625 Broadway, also known as the Torbatti Building, kicks off construction in March to convert the 230,000 square foot Class B office tower to residential apartments. 600 B Street has a package out on the lower portion of the building for sale as a hotel. 101 Ash, formerly known as the Sempra building, may be coming back on the market for multi-tenant use next spring as Sempra moves to their new build-to-suit at the ballpark.

All other office markets continue to show incremental improvement. The most significant improvement has been in UTC where Class A vacancy rates are now under 7%. The overall UTC vacancy rate is somewhat higher, however, when you mix in Class B availabilities and also Campus Point availabilities caused by SAIC moving their headquarters back to the East Coast a few years ago.

One particular area of note in the recent recovery is the I-15 corridor, where a number of companies have been looking to relocate out of the more congested Sorrento Mesa area. Availabilities of large blocks of space over 20,000 square feet have been cut in half in the last year as companies like Intel, which recently expanded by 42,000 square feet, continue to absorb space. Additionally, with MedImpact staying strong and growing, Turtle Beach rumored to be relocating from UTC for 30,000 square feet, and Cox Communications potentially looking for 40,000 square feet, I-15 will likely continue to show improvement between now and the end of the year.

The most unusual trend we’re seeing in the market is in Sorrento Mesa, where there is literally almost as much sublease space on the market as there is direct space from landlords. This is due to the overhang of space available by large companies including American Specialty Healthcare, which moved its headquarters out of San Diego to the Midwest, and has placed all of its space on the market as a result.

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.