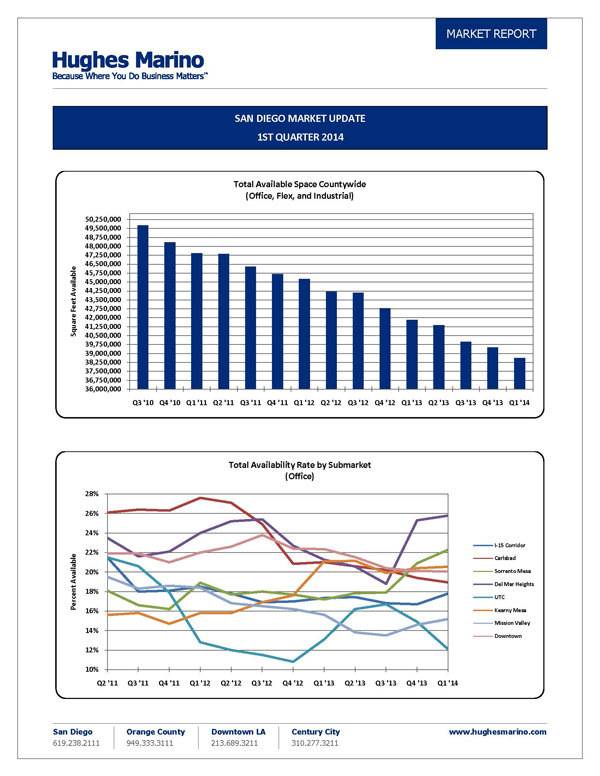

The first quarter of 2014 continued to show the positive effects of the economic recovery and the jobs recovery on commercial real estate. The first quarter saw approximately 878,000 square feet of office, lab and industrial space come off the market on a net basis in San Diego county. This trend line shows a continued decrease in supply on almost a straight-line basis as compared to the prior three years.

Since the absolute depths of the recession in summer 2010, we have had 11 million square feet of space come off of the market. This represents approximately 22% of the inventory that was available during the peak of the recession in mid-2010. This is consistent with the length of recovery that we forecasted four years ago, which we said would take a full four to seven years. Coming out of that very dark time in our regional economy, the pendulum is now just beginning to swing to the landlord’s benefit.

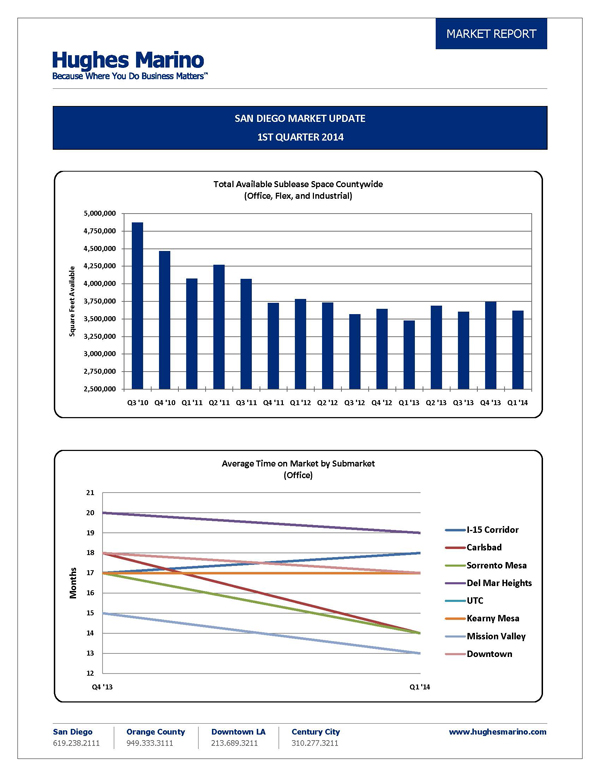

Availability rates generally continue to decline as a result, and total sublease availability has hit a relative equilibrium that has stayed constant for almost two and a half years, hovering around 3.5 million square feet. We continue to watch sublease availability for any spike in supply that could be a leading indicator of an upcoming economic decline, but that is nowhere in our forecast whatsoever. Looking ahead, we anticipate declining supply of large blocks of available space as well as shrinking supply of Class A office space.

What has been most surprising is the decrease in supply of wet lab space in Torrey Pines, as the biotech sector has experienced a remarkable recovery fueled by robust capital markets for life science IPOs. This has led to significant growth within that industry, which has created a high demand for space.

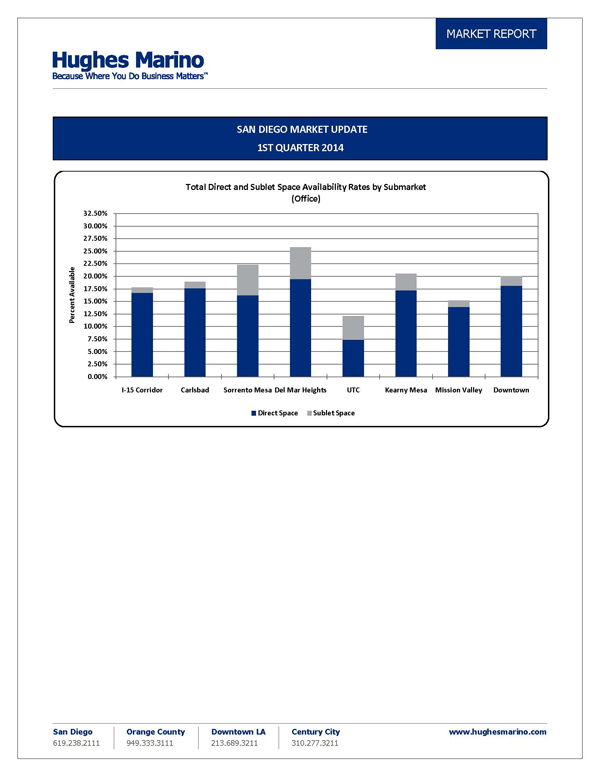

In downtown, there is a widening gap between Class A and Class B office space, both in terms of availability and rental rates. While, on the surface, Class A availability rates seem strong at 16%, the underlying rate is closer to 7-8% as existing downtown tenants expand and new tenants flock to the increasingly desirable area. The Class B office market is a dramatically different story, with availability rates at 30%, compared to a 5-year average of 25%.

Interestingly enough, large blocks of Class B space are being taken off the market altogether. The Torbati Building (625 Broadway) is in escrow to a residential developer who plans on converting the 223,000 square foot office building into high-end condominiums. And The Paladion (777 Front Street), a 156,000 square foot office building in the Marina district, was purchased last year by Bosa, who plans to build a high-rise residential tower in its place.

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.