San Diego tops state in first seven months, even ahead of L.A.

By Roger Showley

Despite economic woes nationally, San Diego County’s nonresidential development picture has seen a healthy increase so far this year, according to the Construction Industry Research Board.

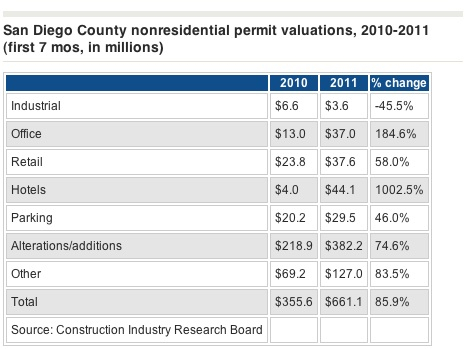

The permit valuation through July was $661.1 million, up 85.9 percent from $355.6 million for the same period last year.

The Burbank-based board said the county had the biggest dollar increase of any metro area, even larger than Los Angeles County’s $161.6 million, a 9.9 percent boost.

Statewide, the total through July was $7.3 billion, up $821.7 million or 12.8 percent higher than for the same period last year. That means San Diego has contributed 43.3 percent of the state’s growth in nonresidential construction activity.

“You might see the commercial real estate sector lead us out of the recession,” said Norm Miller, professor at the University of San Diego, at the San Diego Association of Realtors real estate summit Wednesday. “It’s usually housing that leads.”

Jason Hughes, a partner at the Hughes Marino commercial real estate brokerage in downtown San Diego, said the local upsurge was not a surprise.

“Despite the national doom and gloom, the vast majority of our clients seem to be doing well — they seem to be in an expansion rather than a contraction mode,” Hughes said. “We feel there’s a general optimism that we haven’t seen for years that we are seeing now. We hope that continues despite the ups and downs of the stock market and daily negative news that we continue to see on the national level.”

He said of his company’s 262 clients, about 50 are looking for new space and 70 percent of those need more.

“Several years ago, probably 70 percent of our tenants were in a contraction mode,” he said. “Our clients were looking to downsize. Now I’d say it’s reversed. Most groups have right-sized over the last four years and now are starting to feel a need for a little more space. Obviously there are exceptions, but we are seeing a general sense of more optimism than pessimism, and we hope that continues.”

He offered as examples four clients looking for more space:

- Aperio Technologies, a medical device company in Vista;

- Covario, an Internet company in Del Mar Heights;

- ABrightScope, another Internet company, in Sorrento Mesa; and

- Encore Capital in Mission Valley.

Since 80 percent of tenants typically renew leases with no change, it is the 20 percent that are moving. And of those, Hughes said, many simply want better locations and buildings.

But it the growing companies that promise to fill up vacant space and then prompt developers to move forward with the construction of new buildings — a trend that shows up in the latest statistics.

“In this climate there are so many good options,” Hughes said. “You can go from ‘B’ to ‘A’ space and still pay less rent for the exact same square footage.”

But for those move, he said, they typically are doing so because they are growing and adding staff.

“It depends on the company and submarkets,” he said. “A company downtown may add two people to the firm, but at least it’s in the right direction. We’re definitely seeing an upward trend in hiring. The canaries in the coal mine are showing things are getting better, not worse.”

Mike Alfred, cofounder and CEO of BrightScope, said he needs to move from the present, 3,500-square-foot space to as much as 13,000 square feet by year’s end to accommodate his rapidly expanding workforce.

The company focuses on the retirement plan and financial adviser market and currently has 40 employees with expectations to reach up to 65 by December.

“It’s the story of two economies,” he said. “There are businesses that are either tech-focused or -enabled and everyone else. If you’re not Facebook, Twitter, Groupon, BrightScope, and your whole business is powered by data and tech, you’re struggling to grow.”

He said he’s looking for top-quality space no farther north than Del Mar, and while he’s not looking for bargains, some landlords are charging unrealistic rents in a market that still has much vacant space.

“They still think we’re in a full-scale recovery,” he said. “Real estate people are the most delusional people in the world in a lot of cases.”

Steve Lagotta, Covario’s vice president of finance, said his company has been subleasing space to benefit from low rental rates and avoid long-term space commitments for the fast-growing firm.

“We can get a really nice space for almost two-thirds of what we would have paid three years ago,” he said.

Covario is an Internet marketing and software firm that manages paid and organic search engine advertising. Its employment locally has grown from 65 two years ago to 100 now and will likely reach about 145 in the next two years.

“We’re seeing a slight slowdown, mainly due to uncertainty among our clients, but we’re still growing by leaps and bounds,” Lagotta said.

Jason Hughes is founder of Hughes Marino, an award-winning commercial real estate company with offices across the nation. A pioneer in the field of tenant representation, Jason has exclusively represented tenants and buyers for more than 30 years. Contact Jason at 1-844-662-6635 or jason@hughesmarino.com to learn more.