The UTC office submarket totals 7,680,000 million square feet, encompassing some of the highest quality office space in San Diego County. The commercial leasing fundamentals for UTC have improved dramatically over the last two years as the economy has driven a broader commercial real estate recovery, and Class A space has led the recovery in the region.

UTC — Apples and Oranges

To better understand the UTC submarket, it is necessary to clarify the types of office space that comprise the market. For most people, UTC office space means the Class A office towers along La Jolla Village Drive between the I-5 and the I-805. However, the UTC office market also includes the two-story and low-rise office buildings north of La Jolla Village Drive, running along Towne Centre Drive, Eastgate Mall and Campus Point Drive. The Class A office buildings are seeing very strong recovery, with decreasing availability and increasing rents. Meanwhile, the buildings along Towne Centre, Eastgate and Campus Point are grappling with an onslaught of increasing vacancies in recent months. Examples of larger companies that have relocated, or will relocate, off of the Towne Centre Drive and Campus Point corridors include LPL Financial, CoStar, Celgene, Illumina, SAIC and Lockheed Martin.

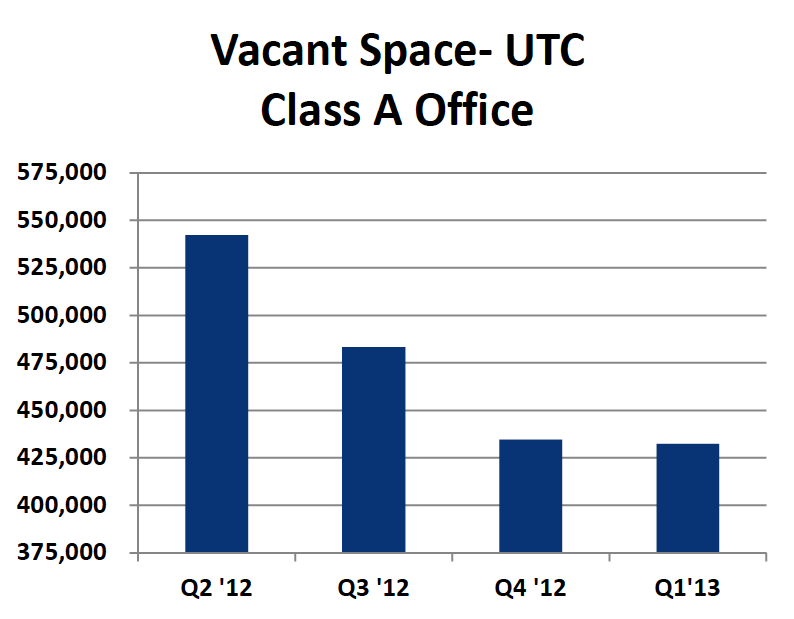

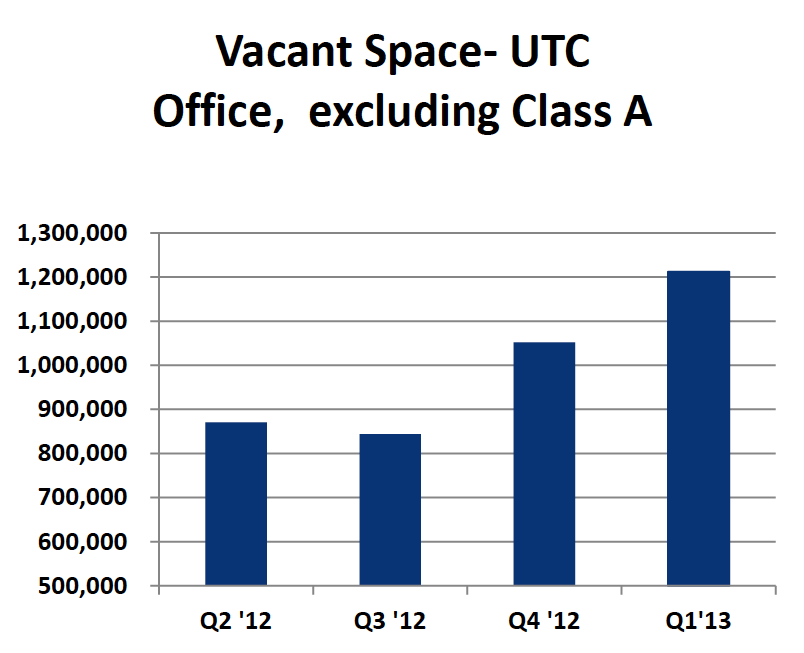

The two charts below illustrate this distinction in property type. As the charts show, vacancy rates for Class A office space have been going down for over three years now. Meanwhile, vacancy of all other office space has been trending up for the last two years.

Strong Market? Weak Market? It Depends.

Bigger Deals, Better Deals

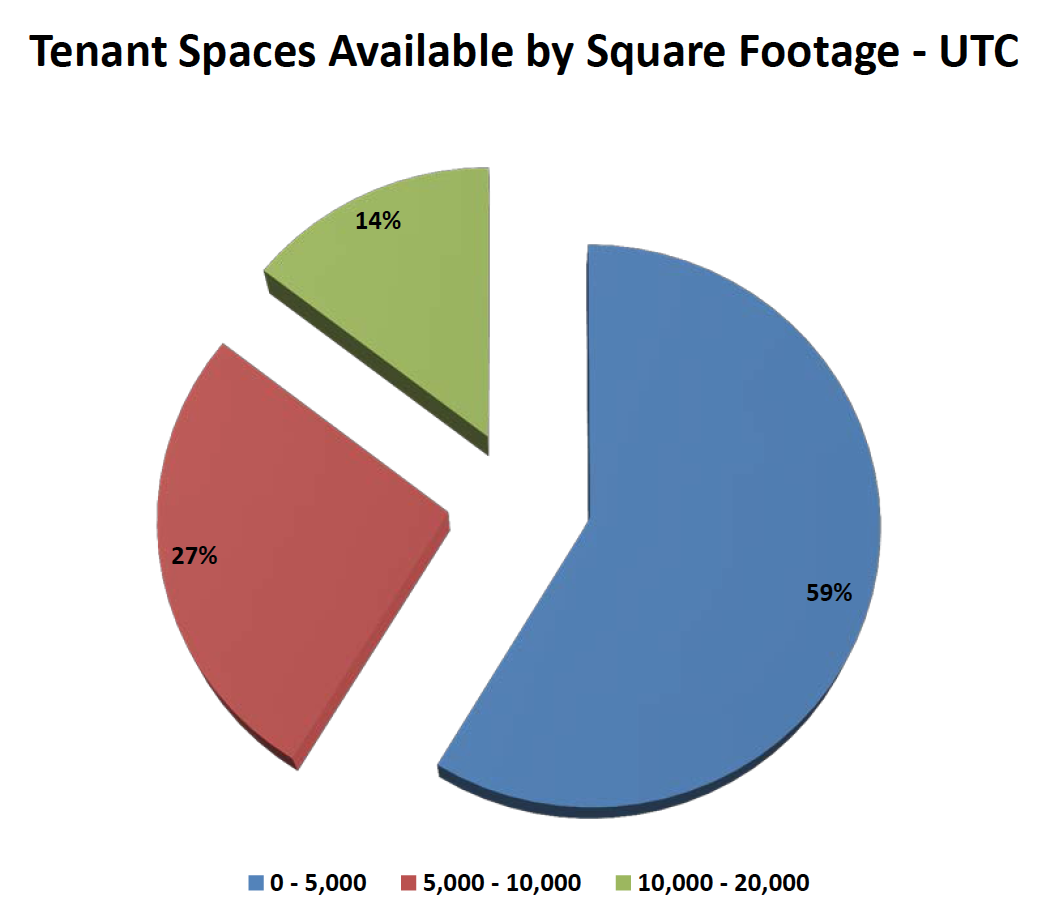

It is also interesting to note that well over half of the companies in UTC occupy less than 5,000 square feet, and the vast majority of the office vacancies in the Class A towers along La Jolla Village Drive are for less than 10,000 square feet. The Class A office buildings cater to these smaller tenants, while the two story and low-rise office properties tend to have larger floorplates and are suitable for larger tenants and corporate headquarter office locations. While the recent increase in the number of larger vacancies off of La Jolla Village Drive will make a significant impact on broad market statistics, the reality is that most UTC tenants are living in the world of decreasing vacancy rates and increasing rents in the Class A buildings.

The Irvine Effect

The Irvine Company is by far the largest landlord in UTC, owning 44% of the total office space and approximately 60% of the Class A building market. Irvine originally owned just the two building La Jolla Gateway office project built in 1985. Over the next two decades, Irvine continued to buy and build additional office properties throughout the submarket. Milton Bradley would be proud, as Don Bren sought to control that corner of the San Diego game board, but raising rents and building hotels would have to wait. The 2008 financial crisis and resulting weak economy forced Irvine to dramatically lower rents in order to stimulate leasing activity. From 2009 to 2011, UTC office rents were cheaper than nearby Sorrento Mesa and Del Mar Heights, and tenants responded by migrating to Class A space “on sale” in UTC. As a result of this influx of tenants, and buoyed by the economic recovery, The Irvine Company is now seeing increased occupancy in their Class A buildings and they have been quick to respond with increasing rental rates. Of note, Irvine is achieving 4.5% annual rent increases, and for the most part, the virtual elimination of free rent offerings. With occupancy rates now at 91% and climbing in the Class A buildings, we expect this trend of increasing rates in the Class A buildings to continue for the foreseeable future.

The Checkerboard

The following larger requirements have recently signed leases in UTC:

- Celgene, relocation and expansion within UTC, from 78,000 to 172,000 SF

- ServiceNow, relocation from Del Mar Heights for 92,000 SF

- Union Bank, relocation from various areas of San Diego into 83,000 SF

- Bank of Internet, relocation from Del Mar Heights for 43,000 SF

- Costar, relocation within UTC for 30,000 SF

- Marks, Finch, Thornton and Baird, relocation from Kearny Mesa for 24,000 SF

- Fixtures Living, relocation from Miramar for 20,000 SF

- National Funding, relocation from Carmel Mountain Ranch on the I-15 for 22,000 SF

What To Watch

UTC is a tale of two markets. The first is a Class A office market along La Jolla Village Drive that will continue to strengthen, while the other is a low-rise office market that will struggle to overcome a glut of recent and upcoming availability. We expect rents to continue to rise in the Class A, while the Towne Centre Drive corridor and Campus Point will be a dog fight between institutional property owners The Irvine Company, Arden Realty and Kilroy Realty as they compete to lease their buildings. These larger landlords will be forced to offer aggressive rates and increasing concession packages as they seek to attract larger tenants from the surrounding Torrey Pines, Sorrento Mesa and Del Mar Heights submarkets.

John Jarvis is an executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact John at 1-844-662-6635 or john@hughesmarino.com to learn more.