By David Marino

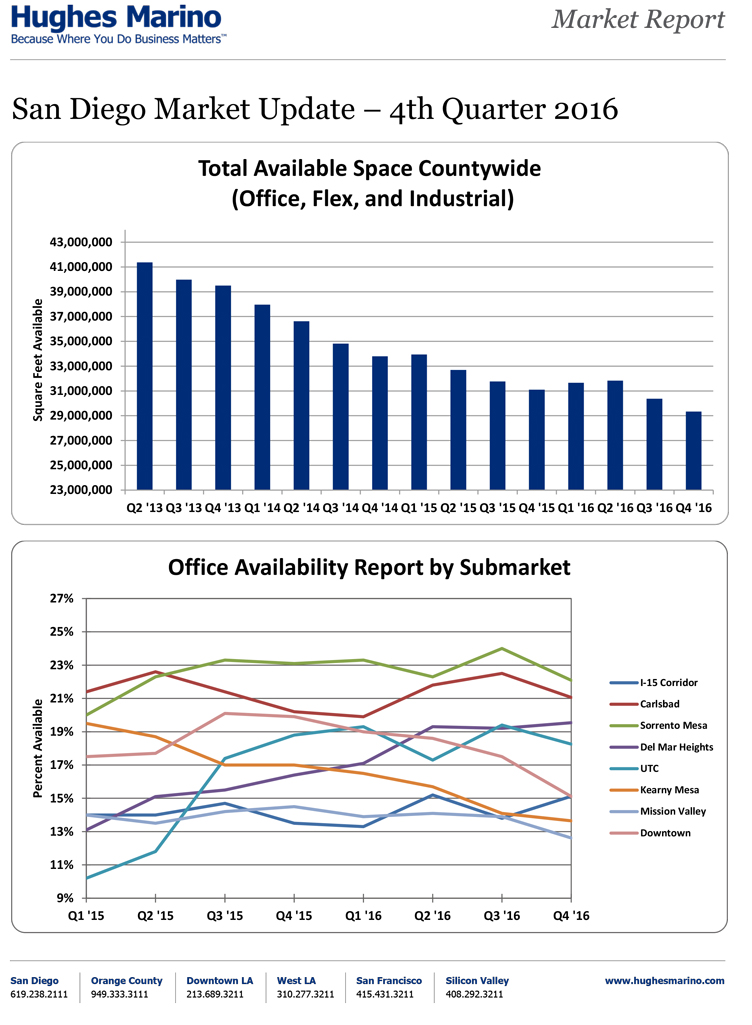

2016 turned out to be another reasonable recovery year for the commercial real estate industry, with just over 1.76 million square feet of office, lab and industrial space coming off the market in San Diego County on a net basis. While not as robust as the recovery years of 2012-2015, where each year and average of 3.64 million square feet came off the market, positive net absorption for 2016 still shows forward progress in the economy and the commercial real estate industry.

One major highlight for 2016 was the strong demand for space driven by the life science industry. Illumina signed a lease for the entire three building Biomed Realty campus in UTC of 316,000 square feet, La Jolla Pharmaceutical Company signed a lease for a new building on Towne Centre Court of 78,500 square feet in UTC, and Heron Therapeutics signed a lease in Campus Point for 28,000 square feet. Sorrento Therapeutics signed a lease for 76,000 square feet in Sorrento Mesa, as did Invivoscribe for 52,000 square feet. Several biotech companies are poised to go public in 2017, and if the capital markets hold, we will continue to see strong demand for life science facilities as they expand their research and commercialization efforts into 2017.

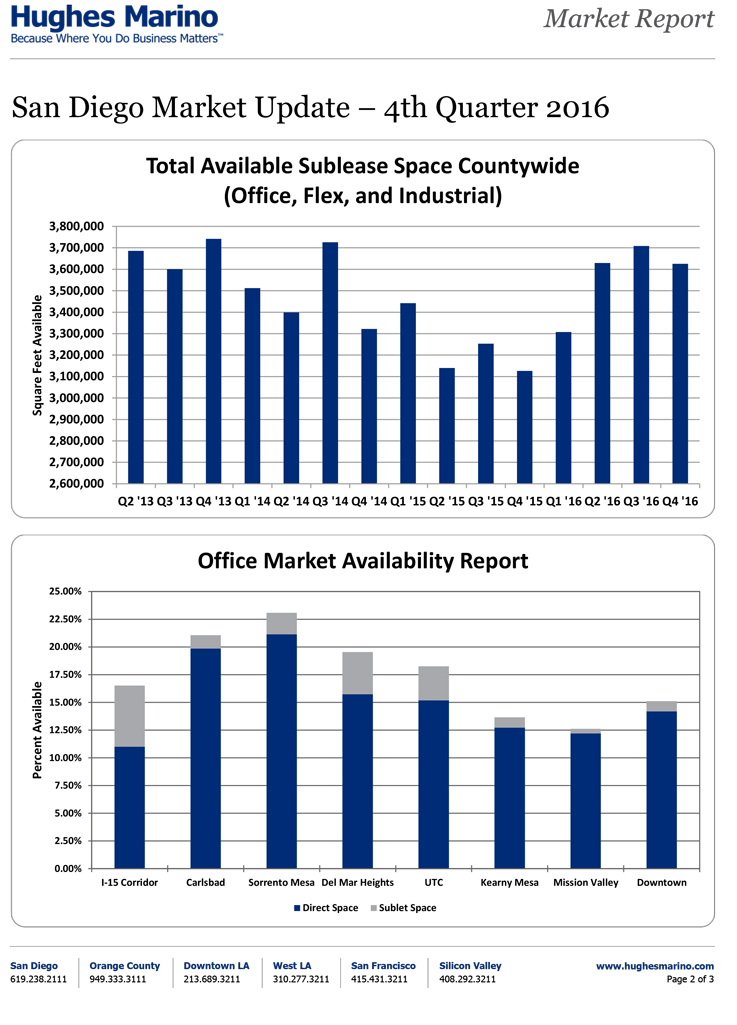

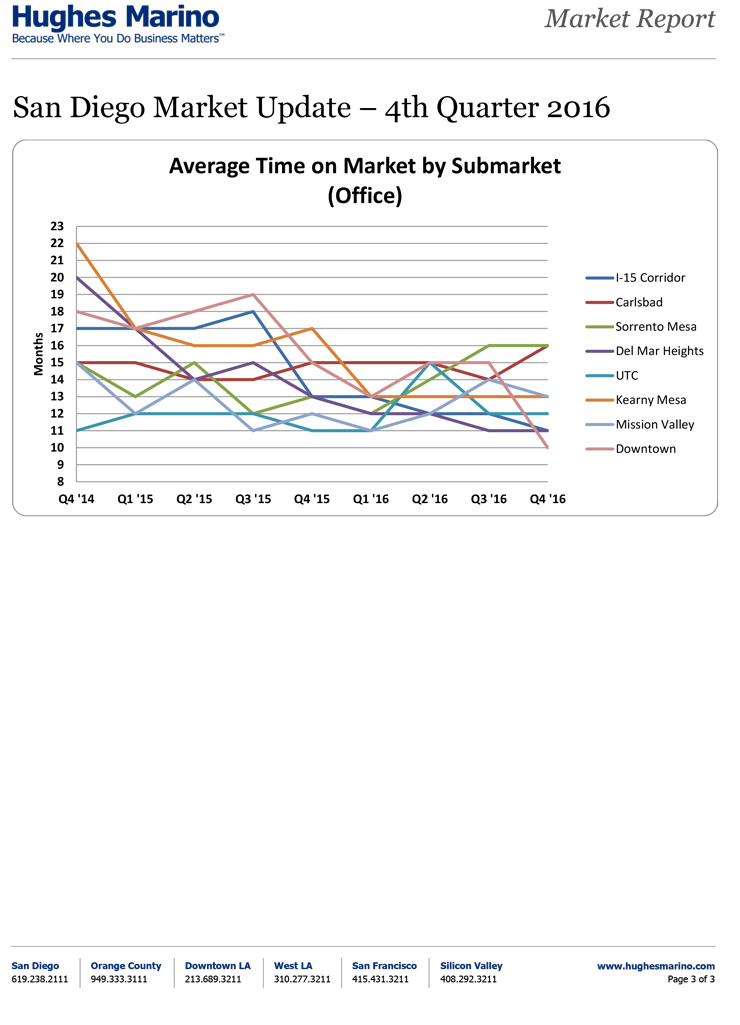

In contrast, the office market was a bit dicey in San Diego County this year. While the I-15 Corridor ended the year with the lowest availability rate at 11%, an additional 5.5% of the total inventory on the I-15 is on the market for sublease. Over 1 million square feet of space is on the marketplace for sublease on the I-15, with more space coming on the market from Broadcom, and landlords are going to have a tough time maintaining any kind of pricing power or leverage on the I-15 throughout 2017 and 2018. UTC ended the year effectively flat with only half of a percentage of availability reduction all year, and we continue to represent clients going into The Irvine Company’s best properties at rents in the $3.00 full service gross range, $1.00 per square foot less than the competition. Tenants with leases expiring in UTC in the first half of 2017 are sure to benefit from The Irvine Company’s continued ruthless price cutting and gaining of market share from the other non Irvine Company landlords in UTC. Carlsbad and Sorrento Mesa both ended the year in the poorest condition with availability rates at 21% and 22% respectively. The relatively isolated location of Carlsbad and the ongoing traffic congestion in Sorrento Mesa has caused both of these markets to lag the rest of the region. The strongest office market story in the county is the robust recovery in Downtown San Diego. Four-point-eight percentage points of availability came off the market in 2016, ending the year at just 15% availability, while space in Class A high-rise buildings with views is in the range of 5%. We are starting to see fierce competition for large Downtown blocks of space over 20,000 square feet. Downtown also ended the year with the lowest “time on the market” that the average space has been on the market at 10 months. In contrast, the average time on the market of an office space in Carlsbad and Sorrento Mesa is 16 months, the highest for any office market in the County.

As an indicator of the health of the economy, total sublease inventory in the County ended the year at just over 3.6 million square feet. It is interesting to note that ever since the economic recovery began back in 2010, sublease inventory in the region has never been below 3.3 square feet or above 3.8 square feet. We have struck a natural equilibrium of what sublease inventory looks like in a healthy market, in contrast to the depths of the recession in 2009 when sublease inventory was almost double that amount. We will continue to track sublease inventory closely as that is a leading indicator of any potential decline in of the health of companies in the region.

For what to watch in 2017, we are keenly tracking UTC with the mall expansion opening in October of 2017. We are already seeing UTC tenants, and even tenants from Sorrento and Del Mar Heights, raise eyebrows at the proposition of being located within walking distance of this $585 million expansion, currently under construction by Westfield, that will bring 90 new stores and a dozen new restaurants to the corner of Towne Centre Drive and Genesee. Projects like “The Plaza” and “Executive Square” are going to become premium priced at the end of this year when everyone realizes that this amenity rich apex is unlike anything north of Downtown. Office and life science companies in the market this first half of 2017 will be smart in getting in now to projects surrounding the mall before prices pop by 20%-25% or more a year from now. Based on current tenant demand and growth we are experiencing real time in the marketplace, we expect 2017 will be another year of strong demand and positive absorption as the employers in the region are healthy and generally have increased demands for space to support employment gains that will be seen in 2017.

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.