By David Marino

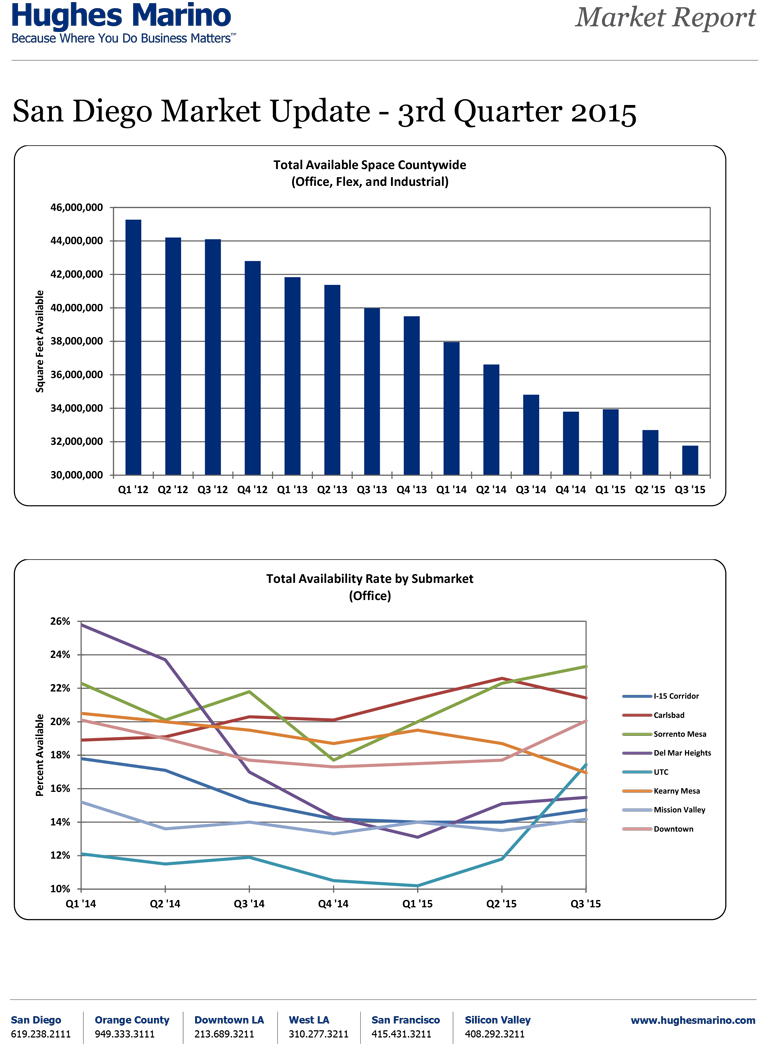

The commercial real estate market in San Diego County continued its strong recovery in third-quarter of this year, fueled by ongoing job creation and the health of the overwhelming majority of San Diego companies. Another net 925,000 square feet of office, lab and industrial space came off the market in the third-quarter, which represents 2.83% of all available space in the county.

At this continued pace, we expect 10% of the space that was available at the beginning of 2015 to come off the market by the end of this year. With virtually no new construction coming online in 2016, our expectations are for continued shortages of space, particularly over 20,000 square feet, and continued upward pressure on rents throughout the coming year.

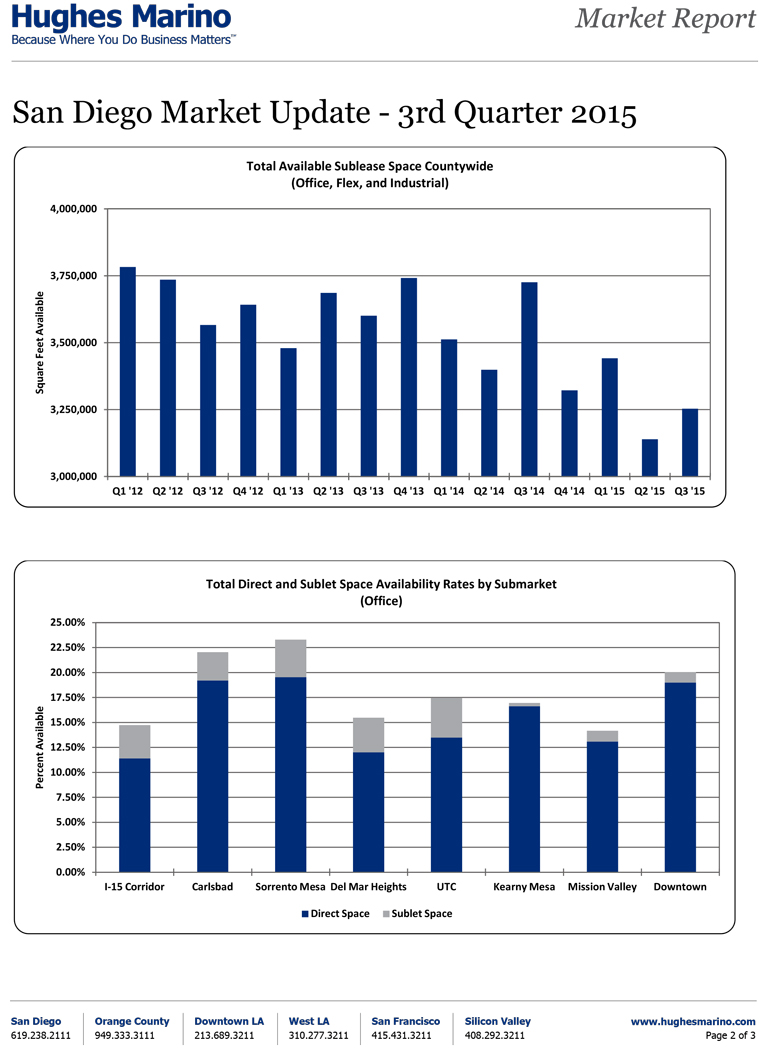

There was tremendous concern this last quarter about the reductions in employee headcount by Qualcomm. In the second quarter of the year, Qualcomm had already announced intentions to shed approximately 74,000 square feet of office space in UTC on Eastgate Mall. This last quarter, Qualcomm also announced intentions to not renew leases at three additional locations: One in Sorrento Towers for 100,000 square feet, another on Pacific Center in Sorrento Mesa for 68,000 square feet, and the third on Vista Sorrento Parkway in Torrey Hills for 86,000 square feet — a grand total of 254,000 square feet.

In light of these unexpected new availabilities, the overall decrease in net availability of nearly a million square feet of space is even more remarkable. Keeping the big picture in mind, over the second and third quarters of 2015, San Diego County has been able to absorb a net 254,000 square feet in three or four weeks’ time. The “Qualcomm effect” is barely a speed bump for the San Diego County region.

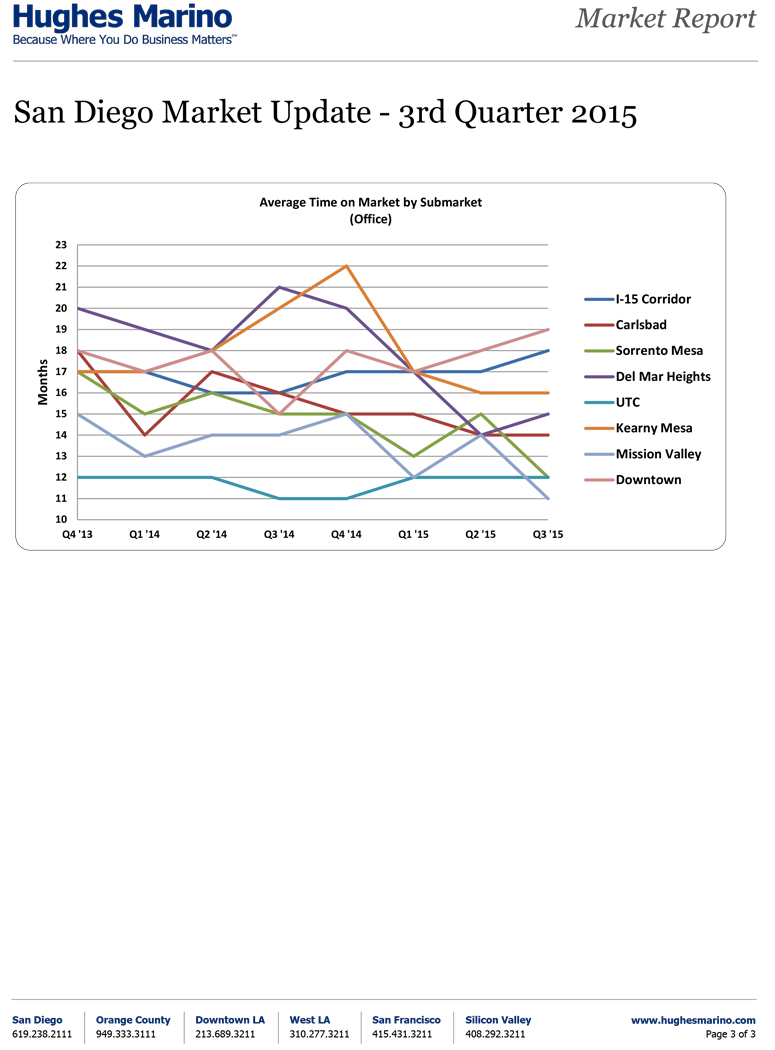

This uptick in availability from Qualcomm will mainly scar Sorrento Mesa. Availability rates there have now spiked to 23.3%, which is the highest rate we have seen in the region since the middle of 2010 when the office market was at almost record high availability. Add in the fact that business owners and executives who make commercial real estate leasing decisions are frustrated with the ongoing congestion getting in and out of Sorrento Mesa, and we expect to see a rough couple of years for landlords that own office buildings in Sorrento Mesa.

The neighboring UTC submarket has also taken an uptick in availability to 17.4%, which is the highest rate seen since early 2012. The single explanation for this is the completion of One La Jolla Center, the Irvine Company’s new class A office tower, which added 245,000 square feet of office space to the UTC market. Asking rents for this new tower range from $4.35 to $4.65 full-service gross, so we don’t expect this new supply to drag down the UTC market, as office availability rates would be the lowest in the county were it not for that additional, high-priced inventory hitting the market this last quarter.

What is most impressive in the region is the sustained recovery for space of all types in Mission Valley, Kearny Mesa and the I-15 corridor. These submarkets offer wonderful value options, as well as the most commuter friendly locations in the region. There has been robust job creation in all of these submarkets, as well as a flight of tenants from the I-5 corridor looking at cheaper space options along the I-15 freeway and areas that are more central to the region. This downward pressure on availability has caused a sharp increase in rental rates year to date, with office space in Mission Valley and the I-15 corridor now pricing at $2.50-$3.00. The “good deal days” in those submarkets are over.

While the stock markets have become a little volatile in the last quarter, the life science industry continues to be robust in its demand for both lab space and office space. There are a dozen life science companies in the market looking for 40,000 square feet and above. As Torrey Pines’ popularity has recovered in the last two years, and availability rates for lab space there are now at a near record low of 12.4%, developers bringing new lab inventory onto the market in UTC are going to be well-positioned to accommodate this growing demand throughout 2016 and 2017. UTC is going to be the place where the action is, with almost a million square feet of new lab space coming on the market in the next two years.

Downtown San Diego’s class A market continues to hover in the single digits as availability for top notch space disappears. The class B market still has plenty of space (over 1 million square feet in Downtown alone) with availability at 40.5%, so tenants looking for space in Downtown need not fear rates in the $4-$5 per square foot range. Several buildings are positioning themselves for sale in Downtown including 525 B Street, 530 B Street, and 1010 Second Avenue, with other buildings close behind contemplating a sale.

Overall, Hughes Marino remains bullish on the regional economy’s projected strength through the remainder of 2015 and well into 2016. Beyond San Diego, we are seeing white-hot markets in Orange County, Los Angeles and Northern California as well. Corporate tenants are well positioned in San Diego from a pricing perspective. Office rents are running $7-$8 per square foot per month in San Francisco, $5-$6 in Newport Center, and $4-$6 along the I-405 Corridor from El Segundo to Santa Monica. Wet lab rents on the San Francisco Peninsula are 50% to 75% higher than in San Diego’s key research markets of Torrey Pines, UTC and Sorrento Mesa. All the way down the peninsula from San Francisco to San Jose, and up to East Bay in markets like Fremont and Milpitas, there’s fierce competition for space and hyperinflation of rental rates — not to mention traffic congestion that now rivals that of the Los Angeles region. Bottom line: San Diego continues to be a great place to start and grow your business.

David Marino is senior executive vice president of Hughes Marino, a global corporate real estate advisory firm that specializes in representing tenants and buyers. Contact David at 1-844-662-6635 or david@hughesmarino.com to learn more.