By Tucker Hughes

The market has continued to move decisively forward at a rapid pace spurred on by limited inventory and optimistic landlord sentiment. We find ourselves in a period where the option value of vacant space can be worth more than it would otherwise be if leased at today’s equilibrium rent. Is this just real estate finance math playing short-lived tricks on tenants, forcing them to overpay, or is this trend here to stay?

The math at a superficial level is relatively simple, and is definitely a requirement in understanding the movement of the market as of late. To offer a simple example, pretend that you are faced with renewing your lease at a rate that is $0.15 per square foot higher than you are willing to pay. At a 5% cap rate this generates $36 of value per square foot of your space:

$0.15/month x 12 months = $1.80 (annual increase in rent)

$1.80 ÷ 5% cap rate = $36 (value gained by landlord raising rent)

Assuming $2.50 per square foot of rent, this means that even with eight months of downtime, zero rent growth (which is unlikely in today’s climate), and an incremental tenant improvement spend of $15 per square foot to attract a new tenant, that the landlord would still be better off letting you vacate unless it jeopardizes the occupancy or desirability of their building substantially:

8 months x ($2.50/month) + $15 = $35 (cost of leaving space vacant)

$36 – $35 = $1 ⇒ Landlord still comes out ahead

Of course these variables can be adjusted and negotiated to improve an individual’s circumstances. However, it proves an important point: Real estate values today, like any fixed income investment, are heavily dependent on future expectations.

So what else is happening out there, all mathematics aside?

The Irvine Company’s latest and greatest high-rise tower in Newport Center is reported to be over 20% leased and gaining traction as multiple full-floor leases are out for signature. The new building will have a huge impact on the area, which is geographically constrained and limited on future entitlements. This begs the question, will rents continue to shoot upwards as the limited supply diminishes, or is Orange County’s most famous landlord monopolizing the market in an unsustainable fashion to keep the cost of moving to their new tower reasonable relative to other alternatives? Only time will tell. In any case, the likelihood of rents decreasing in the near future is very low.

For those of us who don’t have the stomach to pay a medium-sized fortune of rent every month in Newport Center’s high-rise portfolio, a new low-rise opportunity on the 100 block of Newport Center Drive has come available. The project, Gateway Plaza, recently hit the market anew after a retail repositioning of the site was shot down. With asking rates in the low three-dollar-per-square-foot range, this project will almost certainly receive some interest from those being priced out of other projects. Interested tenants should be warned, however, that it will be tough to bargain for lengthy lease terms and renewal rights in this project, as it is a favorable candidate for redevelopment. Further, anyone wanting to do a substantial remodel will have to go elsewhere, as costly new energy efficiency requirements mandated by Title 24 would trigger extensive upgrades that The Irvine Company won’t contemplate given the project’s murky future.

Staying with The Irvine Company theme but escaping Newport Center, interesting news emerged last month, revealing that The Irvine Company has amassed a majority ownership stake in New York’s acclaimed MetLife Building, which came as a shock to many not in the know. As The Irvine Company’s portfolio outside of Southern California continues to expand, the company is starting to hire large national or international real estate companies to advise them on negotiating with tenant brokers and attracting tenants to their buildings. This wouldn’t seem like big news, except that The Irvine Company is known locally for handling all of their leasing in house. So if you’re an Irvine Company tenant being represented by a brokerage firm that is now jockeying to obtain listing work from your landlord anywhere in the nation, then your interests could be severely compromised.

In other Irvine Company news, Irvine Spectrum is rapidly expanding its office footprint, and has doubled down with even more apartment development commitments. This area is truly “filling in” as the live-work-play community center of Orange County. Back up in Airport Area, The Irvine Company’s high-rise portfolio only has one remaining full-floor opportunity, and their low-rise portfolio is 98% leased.

Elsewhere around the county, large blocks of space are becoming more and more limited as many large users continue to make proactive and decisive moves to secure space for future growth. While most of the new deliveries won’t be here for a few years, these users are making a calculated investment as they look ahead to a time when taking down hundreds of thousands of square feet will become untenable. They know that the business loss associated with being unable to grow is often substantially more expensive than the carrying cost of extra real estate. Unfortunately, as supply diminishes, even the largest companies may not have room to satisfy their growth.

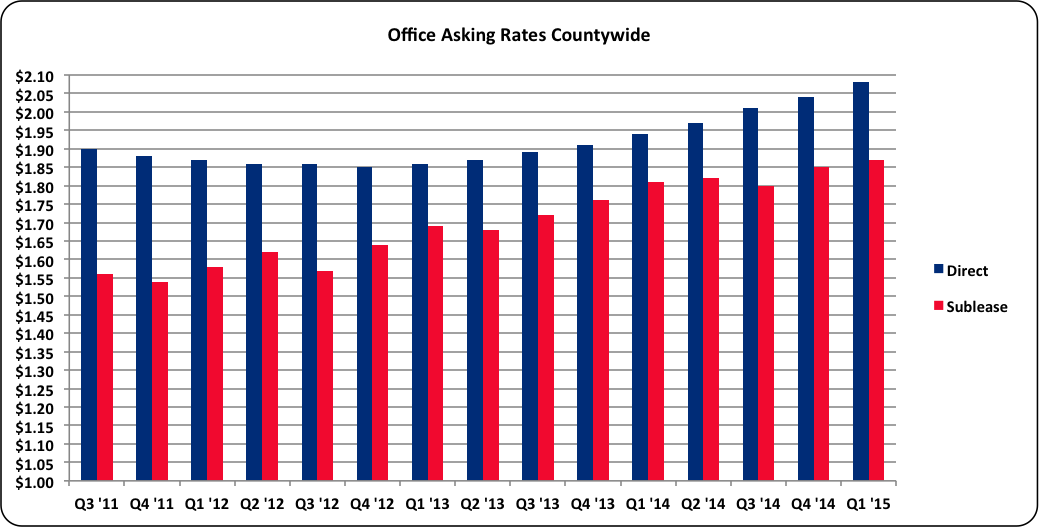

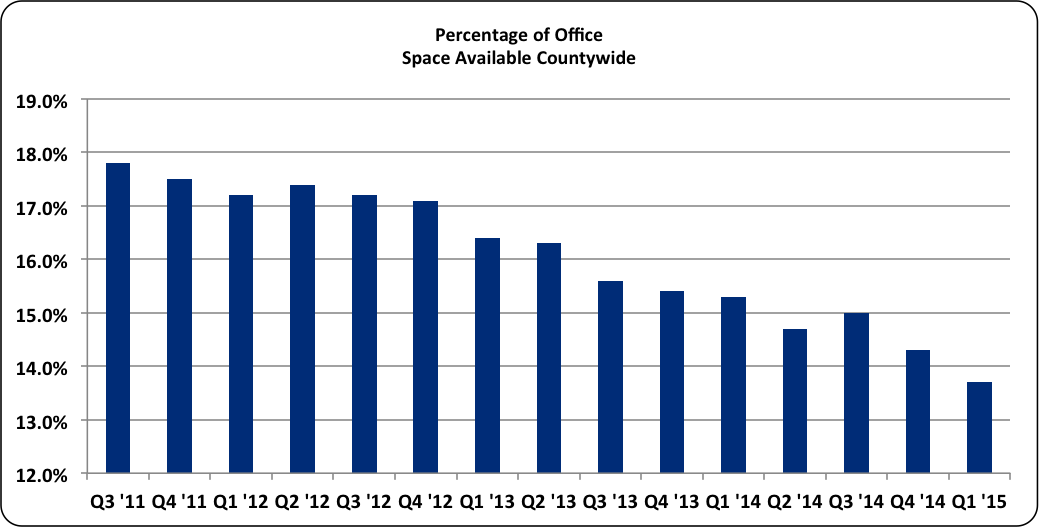

Overall, the market continues to head skyward as rental rates climb and availability drops. Good news for landlords, obviously, but not so much for tenants. Direct leasing rates are up countywide to an average of $2.08 per square foot, while office space availability is down to just 13.7%. The take home message for tenants? Make sure you have good representation to keep you from getting gouged as you negotiate for space. Landlords are not likely to come down much, if at all, in their asking rates. However, a savvy tenant broker can still help you obtain other concessions that will soften the blow to your pocket book.

Tucker Hughes is managing director at Hughes Marino, a global corporate real estate advisory firm that exclusively represents tenants and buyers. As head of Hughes Marino’s Orange County and Los Angeles offices, Tucker specializes in tenant representation and building purchases throughout Southern California. Tucker makes frequent media appearances to speak on the future of commercial real estate, and is also a regular columnist for Entrepreneur.com. Contact Tucker at 1-844-662-6635 or tucker@hughesmarino.com.